A driver with a criminal conviction of any kind, driving or otherwise, will find it harder to find reasonably priced car insurance than someone with a ‘clean’ record. Indeed some insurers stay away from anyone with convictions, no matter how minor, and will refuse cover altogether.

But this doesn’t mean you should give up hope, there will be plenty of insurance companies who will provide cover, and we’ll help you work out how to pick the cheapest and best deals from the ones that do.

In This Guide:

- How do convictions affect the cost of your insurance?

- Declaring your convictions

- How can I find insurance as a convicted driver?

- Types of driving offence

- What if I'm refused cover?

- How can I get a better car insurance deal as a convicted driver?

How do convictions affect the cost of your insurance?

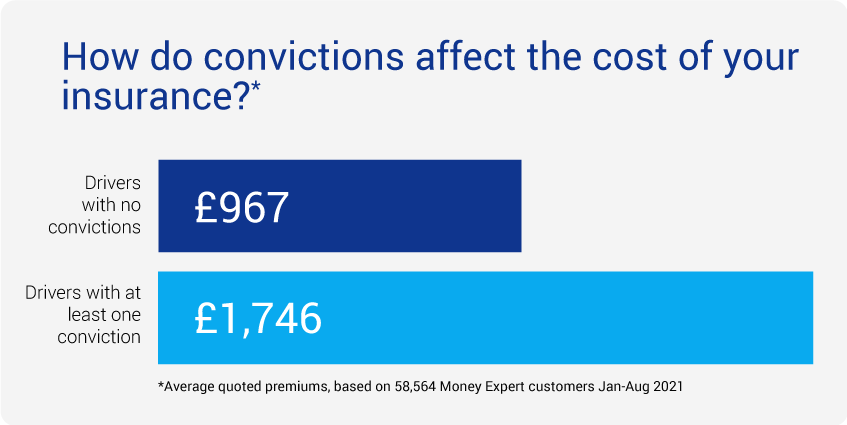

Drivers with at least one conviction pay on average 80% more for their car insurance than drivers with no convictions.

We found that:

- Drivers with no conviction paid an average of £967 for their annual cover

- Drivers with at least one conviction paid an average of £1,746

Declaring your convictions

If you have any unspent convictions, it is imperative that you declare them to your insurance provider when looking for a quote as failure to do so may well invalidate your policy and the company will not pay out in the event of a claim.

Criminal convictions become spent after a certain amount of time depending on the nature and length of the sentence.

If your conviction resulted in community service, it will be spent after five years. If it's a prison sentence of up to six months, you'll have seven years before you don't have to declare it to your insurer. Up to two and a half years in prison will mean your conviction isn't spent until after ten years and any sentence longer than this results in a conviction that will, unfortunately, never be spent.

Do I have to declare spent convictions to my car insurance provider?

Any spent conviction you have does not need to be declared to your insurer. If you have an unspent conviction, you are obliged to declare it, but if your conviction is spent then, according to the Rehabilitation of Offenders Act 1974, it may not count against you in any way.

How can I find insurance as a convicted driver?

Some insurers will flat out refuse anyone with any kind of conviction, and some will refuse those with convictions related to driving, but will offer cover to those with convicted for, say, shoplifting.

Even if your conviction is related to a driving offence, you will still be able to get cover, even if it is harder to find and potentially more expensive.

If you're having trouble finding cover, you can always seek out car insurance companies that specialise in offering cover to convicted drivers, though these providers will generally charge over the odds.

Even if you have to go through one of these specialist convicted driver insurance providers, there are still steps you can take to reduce the costs of your policy, which we'll go through in this guide.

Types of driving offence

The impact of a conviction on your car insurance will depend on the type of offence committed. A criminal or non motoring conviction can have a blanket impact on any kind of insurance policy. Driving offences (that may or may not result in criminal convictions) will affect what kinds of car insurance policy you're offered in different ways.

Drink driving and drug driving

Operating a vehicle under the influence of alcohol or any illegal drug is a serious offence that can result in criminal convictions, imprisonment, and an unlimited fine. Drink driving will result in the issuance of a DR10 (or DR20) endorsement, which will see up to 11 points on your license and an up to 12 month disqualification from driving. You'll find that any car insurance premium you're offered after this will be much higher than before. For more information, read our guide on getting insurance with drink driving conviction.

Speeding convictions

If you've been caught driving over the speed limit, you may be offered the chance to attend a speed awareness course in order to avoid getting points on your licence, a fine, and/or a driving ban. If you attend the course, you avoid having a conviction on your record and you do not need to declare your attendance to an insurer unless they ask you to.

Penalty points

Driving offences of various kinds result in penalty points (or endorsements) on your license. Different offences (including dangerous driving or careless driving, drink driving (see above), failing to stop after an accident, or driving with faulty lights or brakes, among other things) result in different numbers of points. More serious offences lead to points that last longer than others. Points on your license can affect your insurance premiums and can, if undeclared, invalidate your policy. For more information, read our guide on penalty points.

For more detailed information on different types of conviction, head over to our dedicated guides:

- CD10 convictions - driving without due care or attention.

- MS90 convictions - failing to give identifying information on request.

- TT99 convictions - receiving too many penalty points.

- TS10 convictions - failing to obey a traffic signal.

- IN10 convictions - driving without insurance.

- CU80 convictions - using a mobile phone while driving.

- SP50 convictions - speeding on a motorway.

- SP30 convictions - speeding anywhere else.

What if I'm refused cover?

There is an organised, UNLOCK (also known as the National Association of Reformed Offenders) who are devoted to, amongst other things, helping those with criminal convictions find insurance after they've been refused by all of the providers they've contacted.

UNLOCK provide a list of brokers specialised in helping convicted drivers find insurance providers who'll offer them cover. You should always shop around though, even with offers from UNLOCK's affiliated brokers, to make sure that you get the best deals available on insurance for convicted drivers.

How can I get a better car insurance deal as a convicted driver?

If you're conviction isn't driving related, then there's a chance that you've had the opportunity to build up a no claims discount, in which case you could save up to 75% on your premiums, which could go quite a long way to negating the inflation on prices that your conviction has caused.

Other ways to save include choosing the right vehicle in the first place. As a general rule, smaller cars with smaller engines cost less to insure as they fall in one of the lower of the 50 groups as set out by the official Group Rating Panel.

But by far the easiest way to save on your insurance as a convicted driver is to compare quotes online. Our easy to use comparison service will help you find the best deals on the market for convicted drivers so you can rest assured that you'll get cover at a decent price.

If you drive a van, head over to our page on van insurance for convicted drivers.