What is a Mortgage?

A mortgage is a loan from a bank or building society used for the purchase of a property. A mortgage is paid back with interest over a period of several (usually 25+) years. Until the mortgage is repaid, the loan is secured against the property, meaning the lender can repossess it if you fall behind on payments.

How to Get a Mortgage

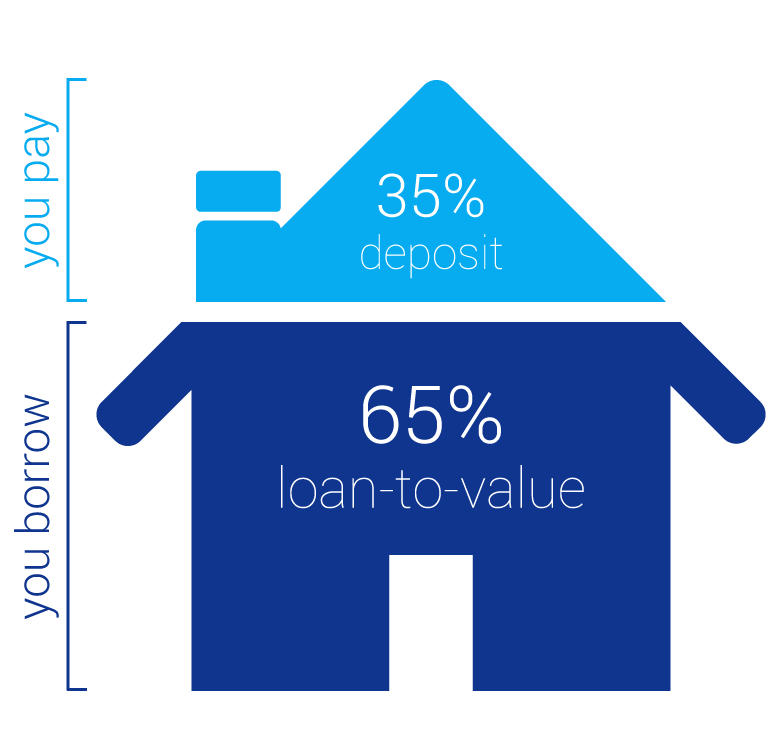

To get a mortgage, you have to pay for a portion of the property yourself up front: this is called the deposit, represented as a percentage of the total value of the property. A 10% deposit on the average UK house, now valued around £377,182, would typically be £37,700.

A mortgage provider lends you the remainder of the cost of the property—expressed in a percentage as the loan-to-value (LTV) ratio. The higher your deposit and the lower your LTV, the more mortgages you'll be able to access, and the less you'll have to pay overall in interest.

How Much Can I Borrow For a Mortgage?

Exactly how much you can borrow will depend on various factors to do with your financial situation as well as, of course, the value of the property that is being put up as security. Lenders conduct a thorough evaluation to work out how much you can borrow. This will take into account your income and expenditure, as well as your credit score.

If you are using your mortgage to purchase a property, then you will need to work out what size deposit you can pay or are required to pay upfront before a mortgage lender will lend you the rest. The difference between the amount borrowed and the actual value of the property is known as the loan-to-value ratio, or LTV.

Say you want to purchase a property worth £500,000, and you're told you need to come up with a deposit of 10% (£50,000). Your mortgage provider then lends you £450,000 which, compared to the original property value, gives you an LTV of 90%..

Different Types of Mortgages

The terms of your mortgage will depend largely on the reason why you're trying to borrow. There are four basic types of mortgages available:

Fixed Rate Mortgages

A fixed rate mortgage comes with an interest rate that remains constant for a period of one, two, three, five or ten years. This means that your monthly payments are locked in for that term, regardless of any changes in the lender's standard variable rate or the Bank of England's base rate. After the fixed term is up, you'll start paying your lender's Standard Variable Rate, which could be higher.

Many people take out a fixed rate mortgage with the intention of refinancing and switching to a product with a more favourable interest rate at this point. As of April 2025, the average five-year fixed mortgage rate is 4.72%, slightly down from 4.84% a year prior. These rates vary depending on deposit size, credit score, and lender.

A fixed rate mortgage will generally have a higher interest rate than you could obtain initially with a variable rate mortgage but it offers the stability of several years of unchanging monthly payments.

Variable Rate Mortgages

A standard variable rate (SVR) mortgage is one with an interest rate that fluctuates. For a standard variable rate mortgage, the interest rate is set and changed by the lender. Traditionally, variable mortgages came with lower interest rates; this isn't necessarily the case anymore and the introductory offers on some fixed rate mortgages can rival those of variable mortgages.

In general, however, you can obtain a better interest rate by opting for a variable mortgage—but you have to be prepared to see it change. It's a good option if you believe you could financially accommodate higher mortgage payments in the future or if you anticipate market circumstances will cause interest rates to drop.

Tracker Mortgages

A tracker mortgage is a type of variable mortgage with an interest rate that's fixed a set amount above the Bank of England's base rate and will change as that rate is adjusted. The Bank of England's base rate is currently 0.75%, meaning a tracker mortgage that follows the base rate at 2% will have an interest rate of 2.75%.

Most tracker mortgages only track the base rate for a set number of years before reverting to the lender's standard variable rate, which will usually be higher. You'll often be hit with early repayment fees if you want to remortgage at this point. On the other hand, lifetime trackers continue to track the base rate until the end of the mortgage term. If the Bank of England's base rate rises precipitously, dramatically increasing your monthly repayments, you'd be able to remortgage and pay off your lifetime tracker without incurring early repayment fees.

Which Type of Mortgage Do I Need?

The terms of your mortgage deal will depend largely on the reason why you're trying to borrow. There are four basic types of mortgage available:

Home Movers

Most mortgages are taken out by people looking to sell up their current house and move to a new one. The kind of mortgage you'll want will depend on a few things. If you've already paid off your mortgage on your existing property, then you may be lucky enough to be able to purchase the new property outright. Alternatively, to keep your cash flow positive, you might want to offer a high deposit and borrow the bare minimum.

If you've still got some way to go on your present mortgage, you've got a couple of options available. You can use some of the cash from the sale to pay off your existing mortgage, and use the remainder (the equity) for a deposit on a new one. In this case, you might face early exit fees. If exit fees are high, you can contact your lender and arrange to port the mortgage over to the new property – though not all mortgage lenders will let you do this.

Find out moreBuy-to-Let Mortgages

A buy-to-let (BTL) mortgage is a loan taken out to purchase a property that you're going to rent out. The monthly rent covers your mortgage payments – as well as other costs and (hopefully) some profit. Most buy-to-let mortgages are interest-only, meaning your monthly mortgage repayments only cover interest on the loan and the principal of the mortgage (the amount borrowed) will not go down over time. At the end of the mortgage term, you then have to pay off that balance, generally by selling the property.

With a repayment mortgage, your monthly payments cover both the principal and the interest so at the end of the term of the loan you'll own the property outright. Monthly payments on repayment mortgages are higher than on interest-only mortgages so the amount you're taking in in rent has to be high enough to cover them. Either way, most buy-to-let mortgages require a deposit of at least 25%

Find out moreFirst Time Buyers

First time buyers, who won't have equity in a previous property to use as a deposit, can access specialised mortgages only available to people who have never before owned a property. These mortgages can be secured with as little as a 5% to 10% deposit. However, mortgage deals with high LTV come with high interest rates. In 2025, first-time buyers make up 32% of all mortgage transactions—a record market share despite rising house prices.

Help to Buy is a government scheme aimed at helping first time buyers with small deposits get onto the property ladder. Help to Buy offers equity loans of up to 20% of a home's value (40% in London). These loans, which are interest-free for five years, let buyers access mortgages with lower LTV % and lower interest rates. Help to Buy is targeted at first time buyers but is technically available to anyone purchasing a home for less than the threshold price and who intends to live in that home full-time.

Find out moreRemortgaging

If you have a mortgage on a home but think you can save money with a mortgage, perhaps from a different lender, you can remortgage your home. Remortgaging is taking out a second mortgage on the value of your home that hasn't yet been paid off; the new mortgage is used to pay off the old one.

Many mortgages come with promotional, introductory interest rates that expire after a few years. The end of the promotional period is the time when many people remortgage, to take advantage of lower interest rates elsewhere. If you remortgage at that point you often won't be subjected to early repayment charges. You may also want to remortgage to take advantage of a new fixed-rate mortgage, which will guarantee you a specific interest rate for a period of time.

Find out moreHow to Find the Best Mortgage Deal for Your Need

Selecting the right mortgage can make a significant difference to your financial stability over the years. Here's how you can find the best mortgage deal tailored to your needs:

- Assess Your Financial Health: Before exploring mortgage options, understand your financial situation. Calculate your income, outgoings, existing debts, and how they will affect your mortgage affordability. Check your credit score as it will impact the interest rates available to you.

- Determine Your Mortgage Budget: Consider how much you can realistically afford to borrow without overstretching your finances. Remember, it’s not just about being able to afford the mortgage payments now, but also in the future, considering possible interest rate rises.

- Save for a Larger Deposit: The size of your deposit affects your Loan to Value (LTV) ratio, and consequently, the interest rates offered. A larger deposit typically secures lower interest rates, making the mortgage cheaper in the long run.

- Decide on the Mortgage Type: Whether it's a fixed rate, variable rate, or a tracker mortgage, each has its benefits and drawbacks. Fixed-rate mortgages provide payment stability, while variable rates might offer lower initial rates. Consider your long-term financial stability when choosing.

- Compare Mortgage Deals: Use mortgage comparison tools to see different deals available in the market. Look not only at the interest rates but also at fees, the flexibility of payments, and other features that might be beneficial for your situation.

- Consult a Mortgage Broker: A broker can offer personalised advice and access deals that might not be directly available on the market. They can also help navigate complex situations like poor credit history or self-employment.

- Consider the Overall Cost: When comparing mortgages, consider the overall cost over the term of the deal, not just the initial payments. Lower interest rates might come with higher fees, affecting the total amount paid.

- Read the Fine Print: Understand all terms and conditions before committing. Look out for penalties, such as early repayment charges, and consider the flexibility of the mortgage, like the ability to make overpayments.

- Plan for the Future: Think about your long-term plans and how they might affect your mortgage needs. For example, if you plan to move in a few years, a portable mortgage, which can be transferred to a new property, might be advantageous.

- Regularly Review Your Mortgage: The best deal now may not be the best in a few years. Keep an eye on the mortgage market and consider remortgaging if better options arise, especially after any fixed-rate period ends.

Do you have life insurance?

Once you've got a mortgage deal it's a good idea to take out a life insurance policy that enables your family to keep up with repayments if you pass away.

With decreasing term cover (or mortgage life insurance) you can make sure that in the event of a claim, the full value of your outstanding mortgage balance is paid off - usually in one lump sum. Premiums are much cheaper than for level term or whole of life cover.

Find affordable life cover guaranteed to match your mortgage. Get peace of mind with MoneyExpert.

Find out more

FAQs on Comparing Mortgages

What is a mortgage?

A mortgage, put simply, is a large loan that is secured against a property. The mortgage provider will lend you money equivalent to the value of the property, generally in order to allow you to purchase the property outright, though mortgages are often taken out on properties that are already owned in order to raise capital for a variety of purposes. You then pay back the mortgage over time, in a manner that will depend on the specific mortgage product taken out.

What is an offset mortgage?

An offset mortgage is one where you can use any existing savings you have as effective overpayments or contributions towards your mortgage balance, with interest only being payable on the remainder. So if you have a mortgage worth £250,000, and you have £50,000 in a savings account, then you will only pay interest on the remaining £200,000. Importantly, unlike with straightforward overpayments, you will still be able to access your savings if you have an offset mortgage.

Can I mortgage a property I want to let out?

Yes, the typical mortgage that most people take out on their property is known as a residential mortgage, but residential mortgages are designed for people who want to live in the home they've bought. If you wish to let out a property then you can take out a specialised buy-to-let mortgage. Buy-to-let mortgages tend to be interest-only, with a repayment plan worked out based on the potential rental income of the property in question.

How long do mortgages normally last?

Usually, mortgages are 25 years in length, but 30 and 40-year mortgages are available through some lenders. Longer-term mortgages will decrease your monthly expenditure but will increase the amount of interest that you pay over the life of the mortgage.

Can I take out a joint mortgage with a partner or friend?

Yes, you will be allowed to take out a mortgage with a partner or friend if you choose to live together. You should make sure, if you do so, that you draw up some kind of trust deed giving both of you power of sale so that you are covered in the event of a dispute. You should also decide, and put in writing, whether you'll be joint tenants (sharing the property on a 50/50 basis) or whether you'll be tenants in common, with each owning a different share depending on your respective incomes.

Will I need to pay any administrative fees when I take out a mortgage?

Usually, you will be charged some extra fees when you come to take out your mortgage. Typical fees include:

- Legal costs

- Valuation costs, and

- Arrangement fees (essentially administrative fees charged by the lender).

Exactly which of these fees (and others) you'll be charged will vary from lender to lender so if you're at all unsure, get in touch with the bank or building society you plan on doing business with and they'll let you know.

Will I be charged for paying off my mortgage early?

Yes, almost all mortgage providers will normally charge what is known as an ‘early repayment charge' if you decide that you can, and wish to pay the whole balance of your mortgage off early. This is essentially because in doing so, you are losing the lender money in interest that you would otherwise be paying over the course of the term. On some repayment mortgage plans, you will be allowed to make overpayments each month, that is, paying more than your usual monthly repayment. Overpayments are typically allowed up to 10% above your standard monthly payment, but again this will depend on each particular mortgage plan, so always check with your lender if you are unsure.

What happens if I can no longer afford my monthly payments?

If for any reason you find yourself having trouble keeping up with your existing payment plan then you should get in touch with your lender right away and let them know. There are various different options you may have available, from taking a repayment holiday (essentially stopping payments for a short time) to starting a new, adjusted repayment plan. It is imperative that you contact your lender as soon as possible though as multiple missed payments could result in your home being repossessed.

Can I still get a mortgage if my credit rating is bad?

There are mortgage plans out there to suit people in a whole range of financial situations so if your credit score is less than perfect, don't worry, the chances are that there is a product out there for you. If you do have a bad credit score, while you will likely still be able to get some kind of mortgage, you won't be able to benefit from the best deals; you'll probably be offered slightly higher than average mortgage rates, or maybe a lower LTV ratio. This is just to reflect the increased risk that the lender is taking by allowing you to borrow money with a less than perfect track record of repaying in the past.

My house has gone up in value, can I remortgage for more money?

Yes you can, this is known as releasing equity subject to affordability checks by your lender. Say you have a mortgage worth £400,000 on a property that is worth £450,000. The £50,000 difference between what you've borrowed and the value is the equity, and is likely what you paid as a deposit. Now if, in this same situation, over the course of a few years, your property goes up in value, say by another £50,000. Then the equity in your property has increased and, if you so desire, you could choose to remortgage and release some of that equity as cash, while maintaining the same LTV on your loan. If you do decide to remortgage though, watch out for early repayment charges that your current lender might charge. The chances are, if your increase in equity is large enough, that it will still be worth remortgaging, but you don't want to be caught off guard by early repayment charges.

What if I want to move house before I've paid off my mortgage?

If you want to move house, you may be able to simply port your existing mortgage over to your new property and continue paying it off as usual.

You may have to undergo new affordability and credit checks if you do so and if your new property's value is significantly different from your old one then the situation may get a little more complicated. If you do want to move house, get in touch with your existing mortgage provider first and they'll let you know what options you have at your disposal.

What is stamp duty and do I have to pay it?

Stamp Duty Land Tax (SDLT), commonly known as stamp duty, is a tax that must be paid when purchasing a residential property or piece of land in England and Northern Ireland costing more than a certain price threshold. The rate of stamp duty varies depending on factors such as the price of the property, whether it is your first home, and whether the property is intended as a secondary residence or a rental investment. Stamp duty is typically paid on a sliding scale, with different portions of the property price falling into different tax bands.

[1] Rightmove via Reuters (April 2025): UK property asking prices up 1.1% year-on-year

https://www.reuters.com/world/uk/uk-property-asking-prices-up-13-year-rightmove-says-2025-04-13

[2] Reuters (April 2025): UK property asking prices rise as mortgage rates ease

https://www.reuters.com/world/uk/uk-property-asking-prices-up-13-year-rightmove-says-2025-04-13

[3] The Times (April 2025): First-time buyers reach record market share

https://www.thetimes.co.uk/article/will-trumps-tariffs-hit-the-uk-property-market-5pbx3rghf

Last reviewed: 1 June 2025

Next review: 1 July 2025

Home Mover

Home Mover  First Time Buyer

First Time Buyer  Buy-to-Let

Buy-to-Let  Remortgage

Remortgage